Time is Precious for Momprenuers, Make Every Minute Count

Feb 21, 2019Hi guys! So I am here with Miss Kamryn today. We want to talk about how when you're momprenuer, your time is so precious. Especially when you're trying to grow a home business.

You want to make sure that you are as smart with your time as possible.

Because we want to spend our time with our kids. That's why we have a home business - to have more time with them and to make more money so that we can spend more time at home with them.

(Kamryn wants to say Hi real quick! -- HI!)

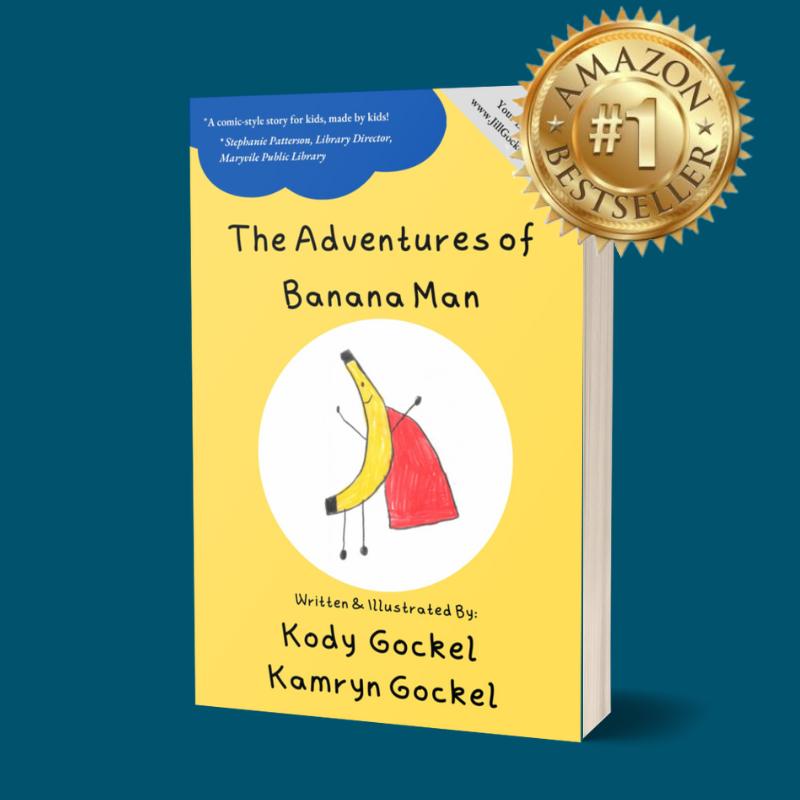

So for those of you that don't know me, I'm Jill Gockel. I'm a certified mom mentor. What that means is I help moms learn to be present with their kids while they're growing a home business or building a career. And what I'm really passionate about is helping with tax strategies and time management strategies.

(Kamryn wants to introduce herself too! -- Yes, my name is Kamryn. I love to play with my mom and dad.)

When we are business owners, we're trying to be really wise with our time! We're out trying to make sales, deliver products, and run errands for the tasks that simply keep our business going.

But the problem is that sometimes we aren't tracking that information properly.

So what happens is that a lot of times, IF you're tracking your mileage, you might just be tracking the date that you are traveling and the amount of miles that you've driven.

Unfortunately that's not enough to make your mileage tax deductible. The reason is that's actually everything that you need to be tracking! So that means that you may be wasting your time writing down your mileage right now.

If you're not tracking it properly then you are going to end up losing those deductions with tax season.

It's important to know exactly what you need to document because mileage is a really easy tax deduction but it is also the most audited deduction.

Why? Because there is hardly anybody that is tracking it properly! So the IRS knows that it's an easy target. Because if you're not tracking even just a few of your trips correctly, they can actually make it so that you have to pay everything back and you lose out on the deductions for all the mileage. And I don't want that to happen to you.

The main thing that I want you to make sure that you are tracking from this point forward is the business purpose of your mileage. So if you are driving to deliver a product, you need to be specific with the purpose. The reason is because this is basically your alibi to say, what my hearsay is, is really true. And I'm backing this up with the proof. So for example, stating that you went to Jane Doe's house to take her an order of essential oils.

Another example is if you are going to the store and you want to go look at printers but you don't actually purchase one. So you don't have a receipt with you to prove that purchase so that's where this mileage tracking and being specific with it comes in so handy. If you specify that you went to the store and you looked at these two specific printers and chose to go back home and do a little bit more research. That's going to hold up way better than just saying that you went to Walmart and how many miles you drove.

That's it! It's a simple thing to add to your mileage record and ensures that when you're taking time away from your kids to do you bookkeeping, that you're using your time to your advantage.

If you'd like more tips on how to make bookkeeping simple, effective, & to save you big at tax time, click here to sign up to be notified when my free 5 Minute Bookkeeping master class opens for registration. You can also click here to grab the free tax deduction cheat sheet that has around 70 deductions that you could be qualifying for on your taxes.

Now a quick note from Kamryn, "So I know how to stay strong and healthy, so eat a lot of food to get strong. And you have to eat the healthy food to get strong and to get healthy. Eat a lot of healthy food every day."

So that's our tip from Kamryn today. Make sure to Like and Follow my Facebook page and Instagram to get more tips about taxes, businesses, and being a carefree mom.

From our family to yours, we hope you have a great day.

Jill & Kamryn

Stay Connected!

Join the mailing list to receive weekly tips, inspiration, and podcast highlights.

We hate SPAM. We will never sell your information, for any reason.